Dive into Hyperliquid Ecosystem dApp #3: AMM DEXs

Hyperliquid, HyperEVM, AMM DEX, KittenSwap, HyperSwap, Laminar

As the transition of $HYPE from HyperCore to HyperEVM accelerates, liquidity inflows into AMM DEXs (Automated Market Maker Decentralized Exchanges) are rapidly increasing, leading to a notable rise in TVL (Total Value Locked). The most actively used DEXs currently are @KittenswapHype and @HyperSwapX. This research delves into the structural differences between the two protocols and analyzes the competitive landscape going forward.

To briefly explain what an AMM DEX is: unlike orderbook-based exchanges, where buy and sell orders are directly matched, AMM DEXs conduct trades via liquidity pools. These pools typically follow the constant product model x*y=k and are composed of two assets (e.g., BUDDY/HYPE).

HyperSwap

HyperSwap is a fork of Uniswap v2 and v3 deployed across 34 EVM-compatible chains including Ethereum mainnet, and functions as a representative AMM DEX on HyperEVM.

Uniswap v2

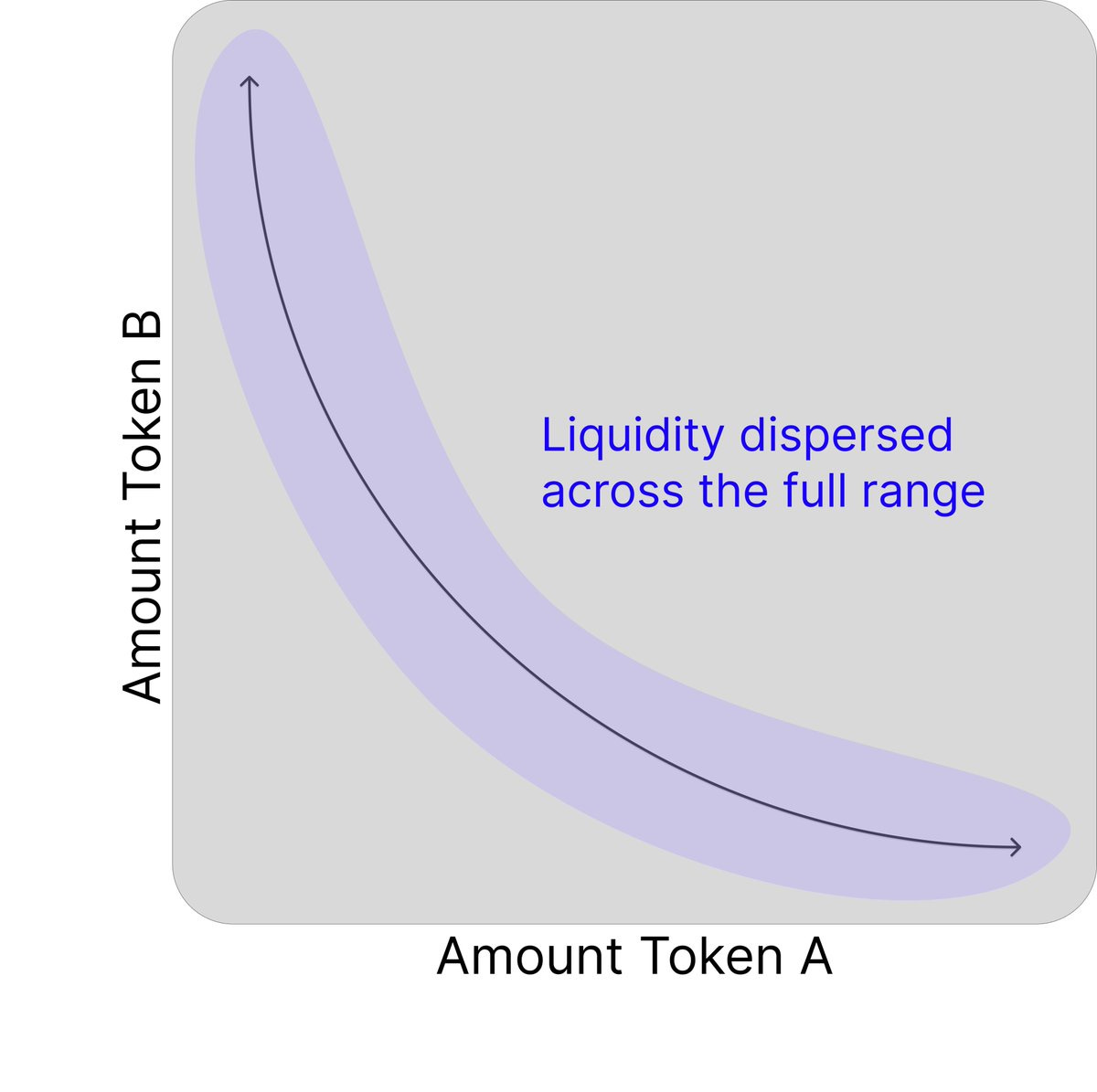

Uniswap v2 implements the classic x*y=k model. Liquidity providers deposit two assets of equal value to receive LP tokens. A 0.3% trading fee is charged and distributed proportionally to LPs.

However, since liquidity is spread across the entire price curve from zero to infinity, capital efficiency is low and profitability for LPs may be limited. Large trades can cause significant slippage due to the distributed nature of liquidity.

Nevertheless, due to its simplicity and intuitive user experience, it is preferred by users who are less familiar with AMM mechanics.

Uniswap v3

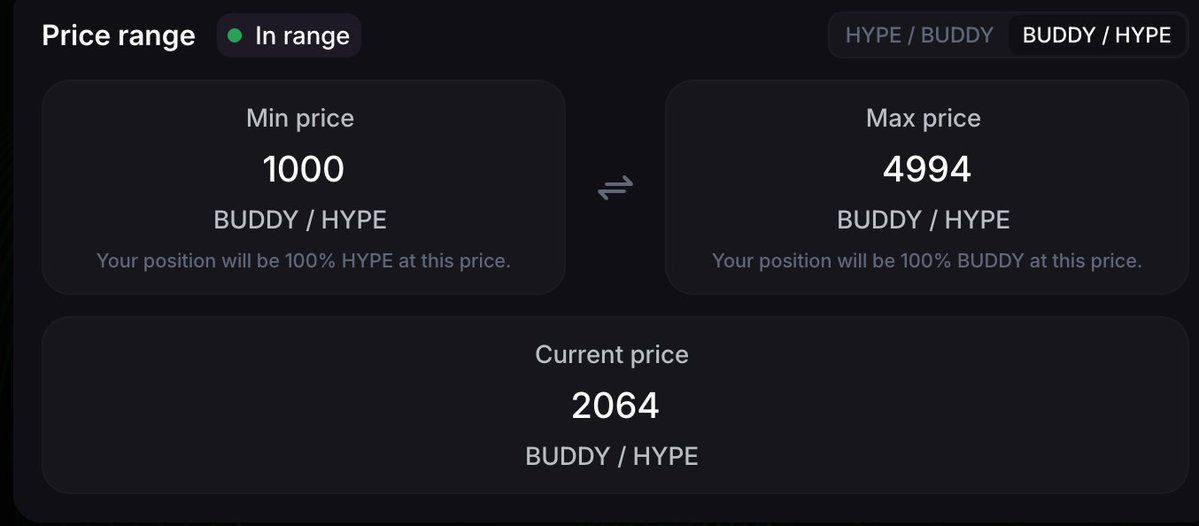

Uniswap v3 addresses capital inefficiency by allowing liquidity providers to concentrate their liquidity within specific price ranges. This enables LPs to earn higher fees with the same capital by placing it where trades are more likely to occur, and users benefit from reduced slippage.

Liquidity providers can also choose among fee tiers (0.01%, 0.05%, 0.3%, 1%) to construct tailored strategies. However, this model demands high-level management skills, including price range settings and fee strategies, thus favoring professional market makers.

HyperSwap v2/v3

DEX Model

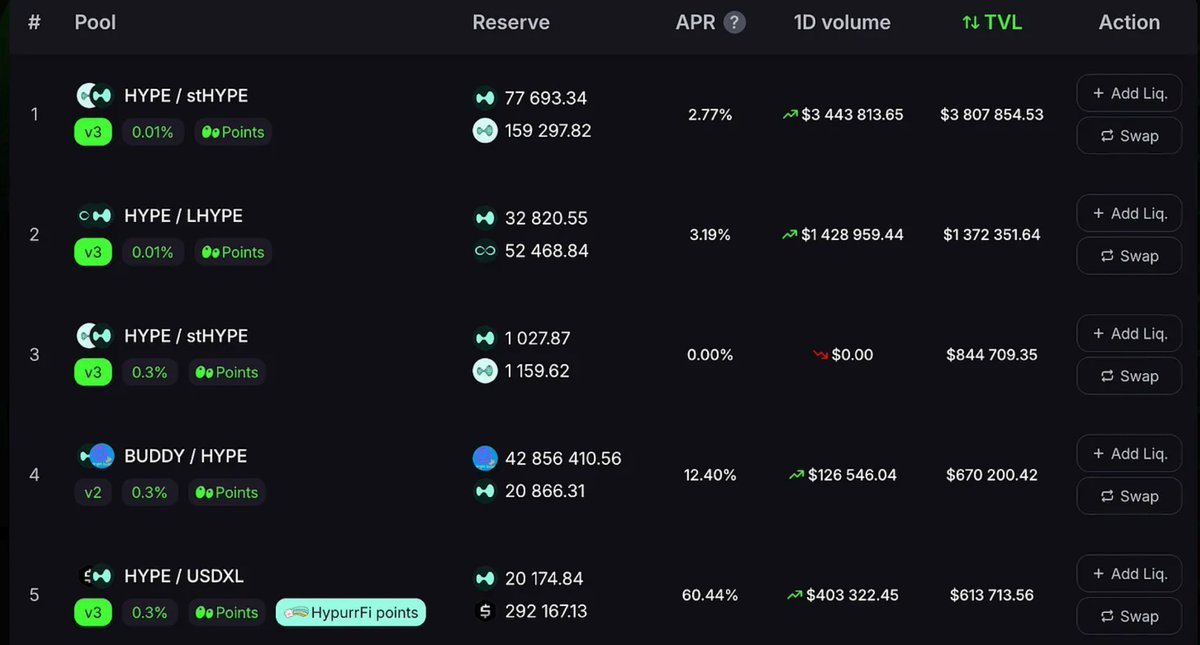

HyperSwap, having forked both Uniswap v2 and v3, offers both models under separate categories. TVL is heavily concentrated in v3 pools, reflecting a preference for concentrated liquidity by both users and LPs on HyperEVM.

While most pools currently operate at a 0.3% fee, pairs like HYPE/stHYPE that utilize a 0.01% fee dominate in terms of trading volume. This suggests a trend toward low-fee pools in the future and indicates that the v3 model is likely to become HyperSwap's core structure.

< Roadmap - Dynamic Fee >

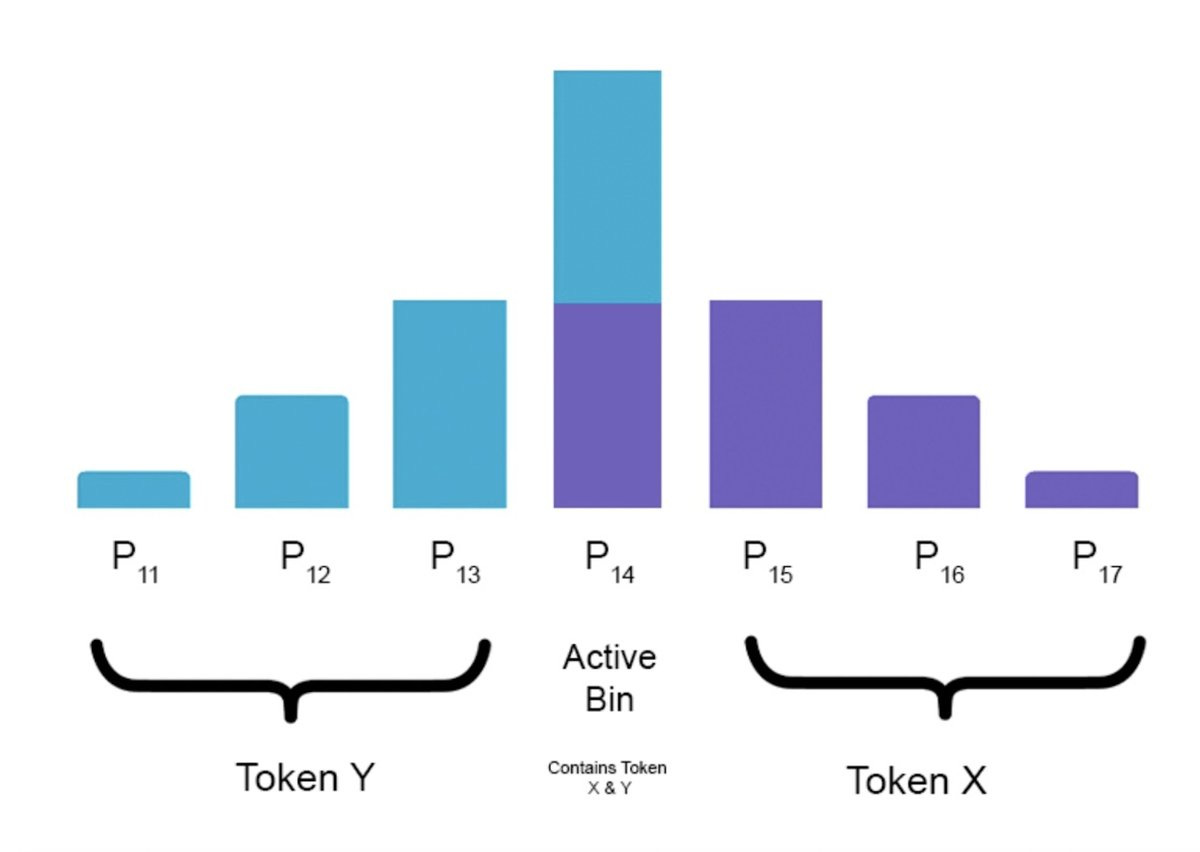

HyperSwap plans to adopt a DLMM (Dynamic Liquidity Market Maker) model, similar to Meteora. Like Uniswap v3, it allows for liquidity concentration within price ranges, but liquidity is deposited in discrete "bins" resembling an orderbook. Within active bins, price formation occurs without slippage, and fees vary when moving between adjacent bins.

This model benefits LPs in volatile markets with higher fees, while offering slippage-free trades in stable markets. It also supports more professional, granular liquidity deployment strategies, representing an evolution of the AMM model.

Ecosystem Partnerships

HyperSwap is expanding its utility through strategic partnerships within the HyperEVM ecosystem. Collaborations include @Looped_HYPE (automated looping strategies using staked HYPE) and @mizulabs (bridging Ethereum assets into HyperEVM liquidity). Through its integration with @LiquidLaunchHL, a token launch platform on HyperEVM, HyperSwap supports automated listing and liquidity provision once certain market cap thresholds are met, further enhancing its role beyond a typical DEX.

HyperSwap Usage Guide

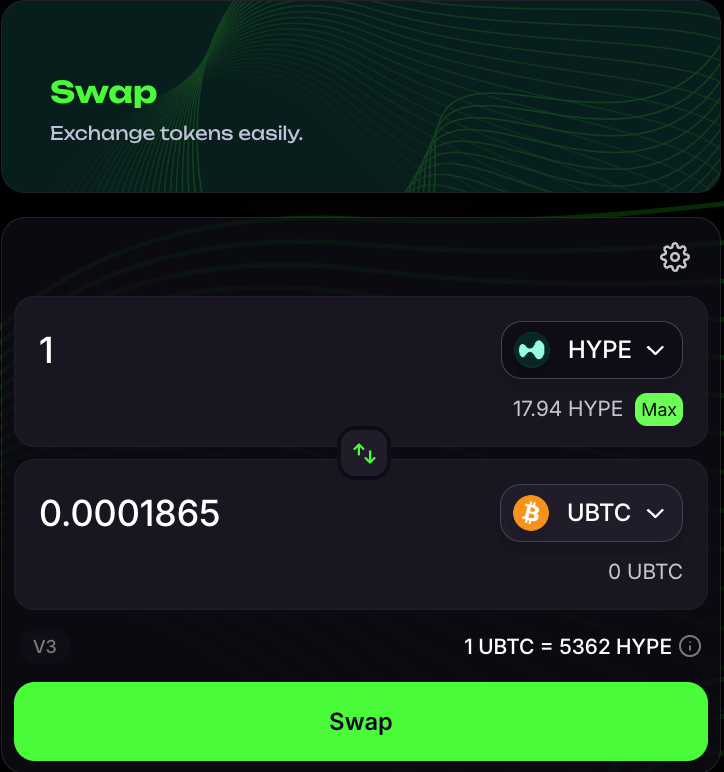

2. Swap

The user interface is designed for accessibility. When initiating a swap, the system automatically selects the optimal route between v2 and v3 pools based on liquidity.

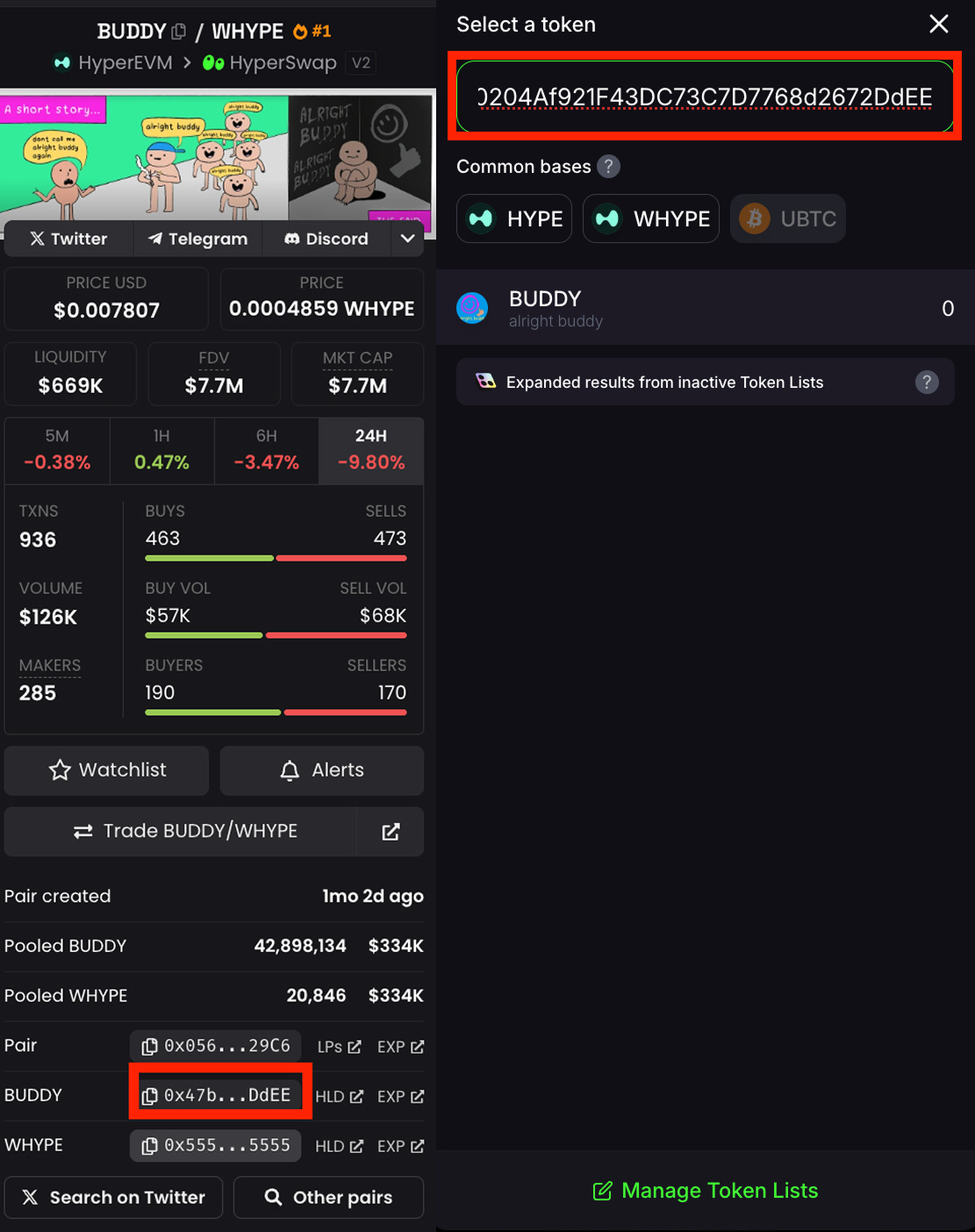

If a token is not on the default list, users can manually add it via address from DEX Screener, supporting accessibility to long-tail assets.

3. Providing Liquidity

For higher returns, LPs tend to prefer the v3 model over v2. The v2 model simply requires depositing equal value tokens, while the v3 model demands comprehensive consideration of fee tiers, APRs, trading volume, and TVL.

For instance, in the case of HYPE/stHYPE, the 0.01% fee pool sees concentrated volume, rendering other pools less profitable. Maximizing returns often requires depositing within narrow price ranges in low TVL/high volume/high fee pools.

However, such strategies carry risks including zero-reward zones when prices move outside the chosen range, necessitating position shifts and resulting in periods without fee generation. This could also result in Impermanent Loss (IL).

Example:

100 HYPE at $15 each + 1,500 USDC = $3,000 deposit If held

value rises to $4,500 If LP'd

value decreases to $4,242 due to rebalancing

This loss is structural, resulting from the AMM algorithm's rebalancing to maintain ratio as HYPE price rises.

KittenSwap

While HyperSwap is based on Uniswap v2/v3, KittenSwap adopts the Velodrome v1 model—a dual AMM model deployed on HyperEVM. It differentiates between volatile and stable asset pools.

Velodrome v1

Velodrome v1 distinguishes between volatile pools (x*y=k) and stable pools (Curve-like model). The stable pools are optimal for assets with similar values (e.g., USDC/USDT), supporting large trades with minimal slippage. Fees for stable pools are set as low as 0.02%.

Unlike Uniswap, Velodrome does not distribute trading fees directly to LPs. Instead, liquidity providers receive VELO tokens, which must be locked as veVELO to receive yield. This separates governance and incentives, promoting liquidity retention.

KittenSwap v1

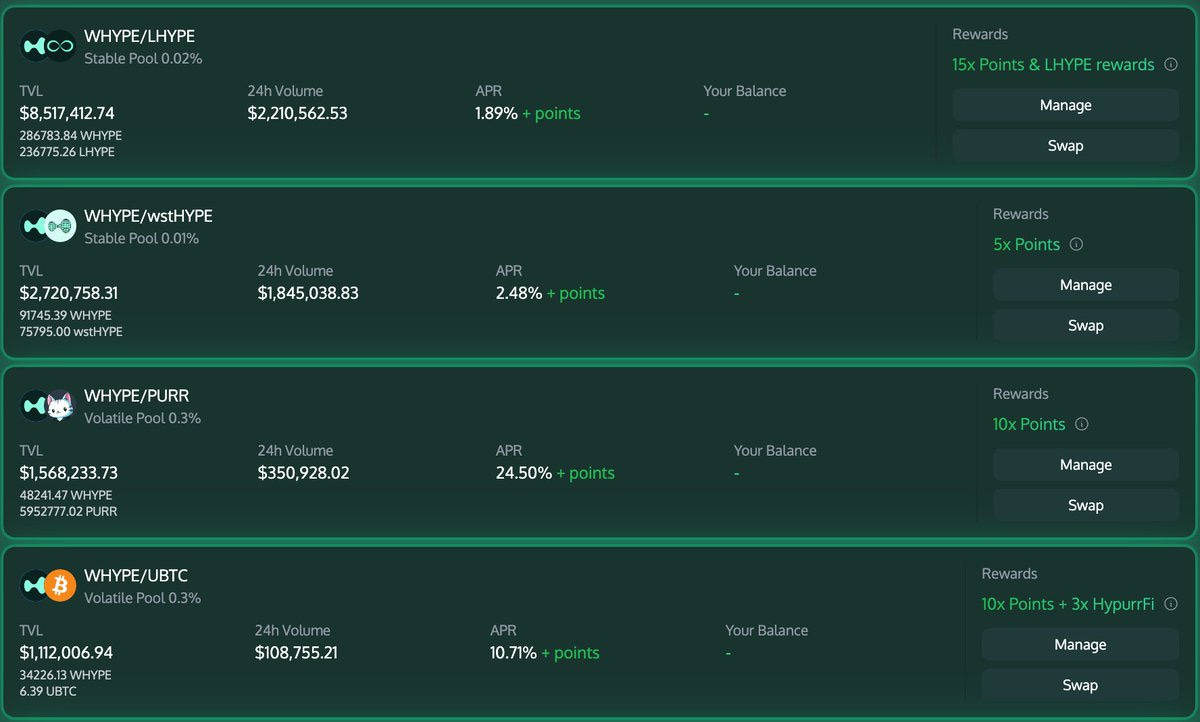

KittenSwap mirrors the Velodrome model on HyperEVM. It runs a dual AMM system for volatile and stable pools:

Stable pools include WHYPE/LHYPE, WHYPE/wstHYPE, KEI/USDXL, etc., with fees between 0.01%-0.02%, offering lower slippage than HyperSwap v2/v3.

Volatile pools charge 0.3% and structurally resemble HyperSwap v2.

KittenSwap plans to introduce CIAMM (Concentrated Intelligent AMM) and Velodrome's Slipstream system, offering Uniswap v3-like capabilities and project-based liquidity incentives.

KittenSwap's Strength: Fast Execution

KittenSwap achieved early TVL by strategically combining fast development and reward multipliers, collaborating with major LST and stablecoin projects like LHYPE, USDXL, KEI, and feUSD.

KittenSwap Usage Guide

1. KittenSwap Interface Access

2. Swap

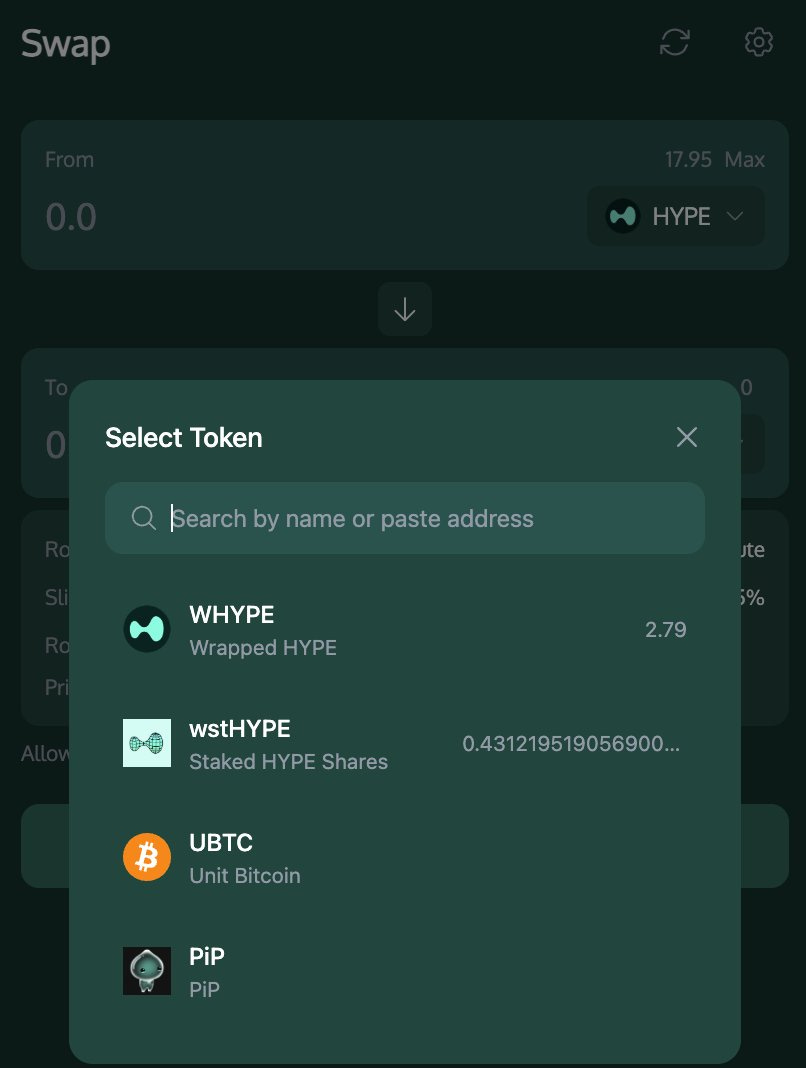

Swap UI is similar to HyperSwap, supporting token address search and direct input.

3. Providing Liquidity

Select asset pair and choose stable or volatile pool based on value correlation. WHYPE/LHYPE and KEI/USDXL go to stable pools; PURR/HYPE to volatile pools. Following pre-existing pool strategies is advised for beginners.

Note: Stable pools carry minimal IL/slippage if peg holds. Volatile pools mirror Uniswap v2 with higher fees, lower efficiency, slippage, and IL risk.

HyperSwap vs. KittenSwap

Tokenomics Comparison

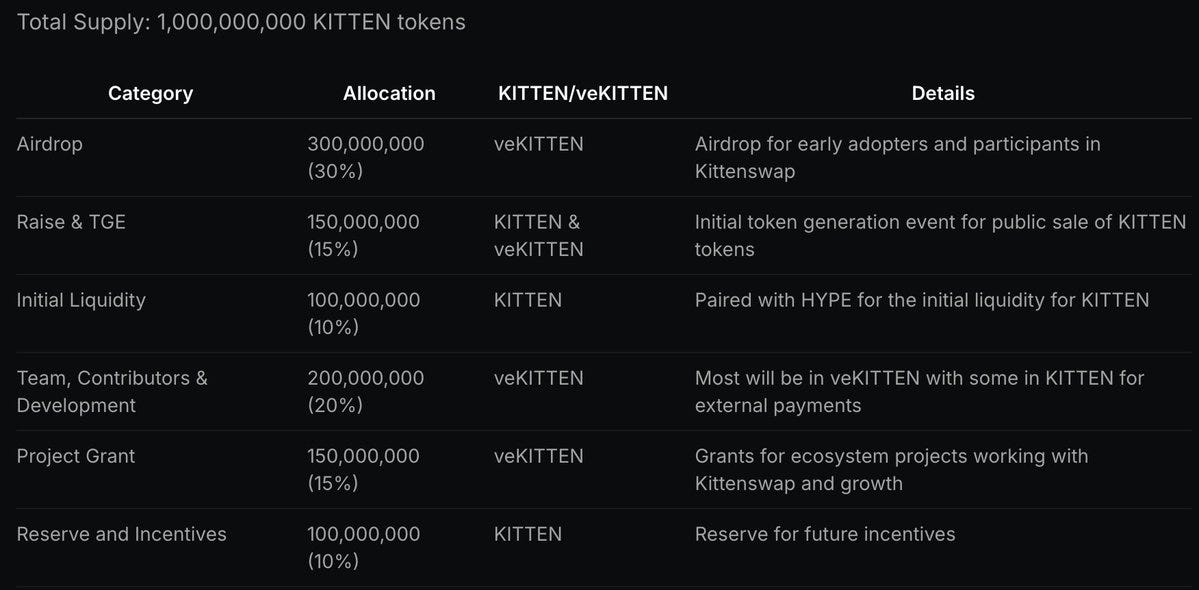

KittenSwap utilizes veKITTEN/KITTEN tokenomics. veKITTEN is an NFT-based locked token with 1 week–2 years lock options, granting holders full fee revenue and governance rights.

30% of tokens are allocated to early-stage incentives: 12% for token sale, 3% for Mechacats NFT holders, 10% for liquidity incentives (13.75% will enter circulation initially).

While effective short-term, such aggressive incentives carry risk of token price drop and liquidity exit unless sustained by long-term user retention.

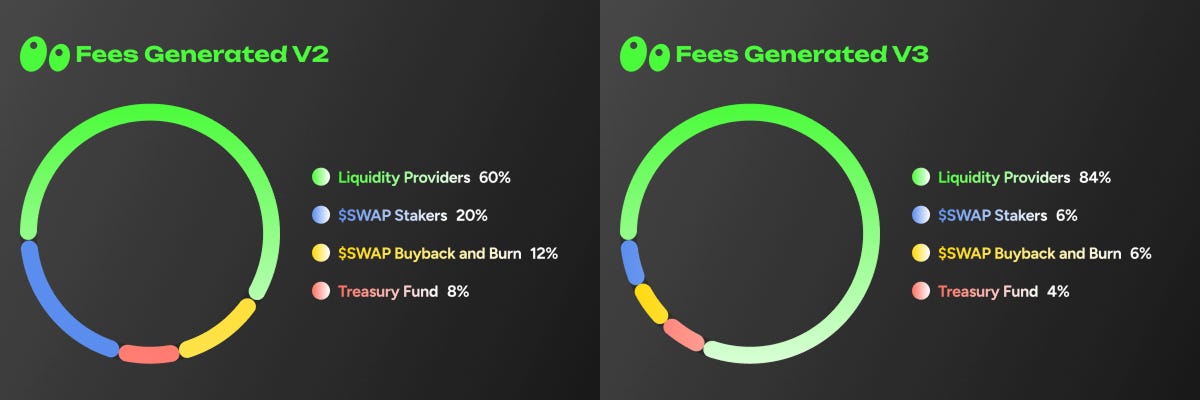

HyperSwap has yet to release detailed tokenomics. Currently, it uses $xSWAP rewards with a vesting period of 15 days to 6 months. v2 pools allocate 20% of fees to $xSWAP stakers, and v3 pools allocate 6%. Given that most volume occurs in v3, yields for $xSWAP stakers are relatively limited.

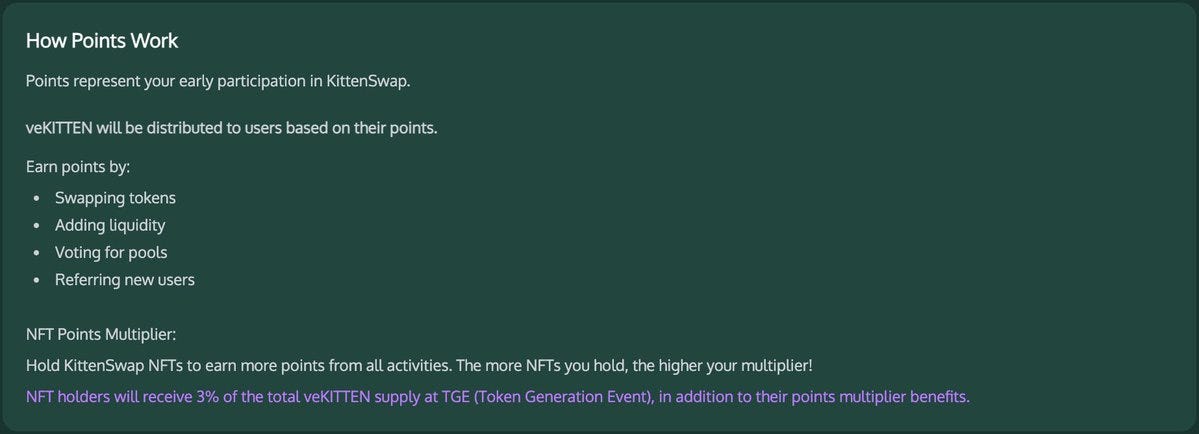

Point System

HyperSwap runs a 10-week point program distributing 10M points. Users earn points via swaps, LP, and referrals. Early adopters benefit from weighted rewards.

Special attention is given to leveraged pool LPs and active participants.

KittenSwap distributes 30% of its token supply via points to LPs, community contributors, NFT holders, and referrers. Mechacats NFT holders receive boosted rewards. Token airdrops are planned for veKITTEN holders.

Token/Valuation Metrics

According to Coingecko and DefiLlama, both DEXs show high trading efficiency. HyperSwap's Volume/TVL ratio is 1.87—highly competitive. This suggests low-fee pools capture volume, concentrating profits among select LPs.

KittenSwap's FDV is $8M as of March 27, with FDV/TVL = 0.42—below market average of 1.42. However, only 25% of tokens are immediately claimable. Claiming incurs a 50% penalty or requires 2-year veKITTEN lock. Breakeven requires FDV to reach ~$32M, subject to market conditions.

Secondary market trading of veKITTEN NFTs is also possible.

Other DEX: Laminar

Will there be a winner between HyperSwap and KittenSwap on HyperEVM? Based on current functionality, both are typical AMM DEXs without standout features compared to other chains.

Hyperliquid's strength lies in its fully on-chain orderbook-based Spot and Perp trading infrastructure, offering lower slippage and more efficient capital utilization.

AMM DEXs on HyperEVM may not leverage this advantage fully, potentially leading to capital inefficiency. To address this, projects like Laminar aim to connect AMMs to HyperCore’s orderbook infrastructure.

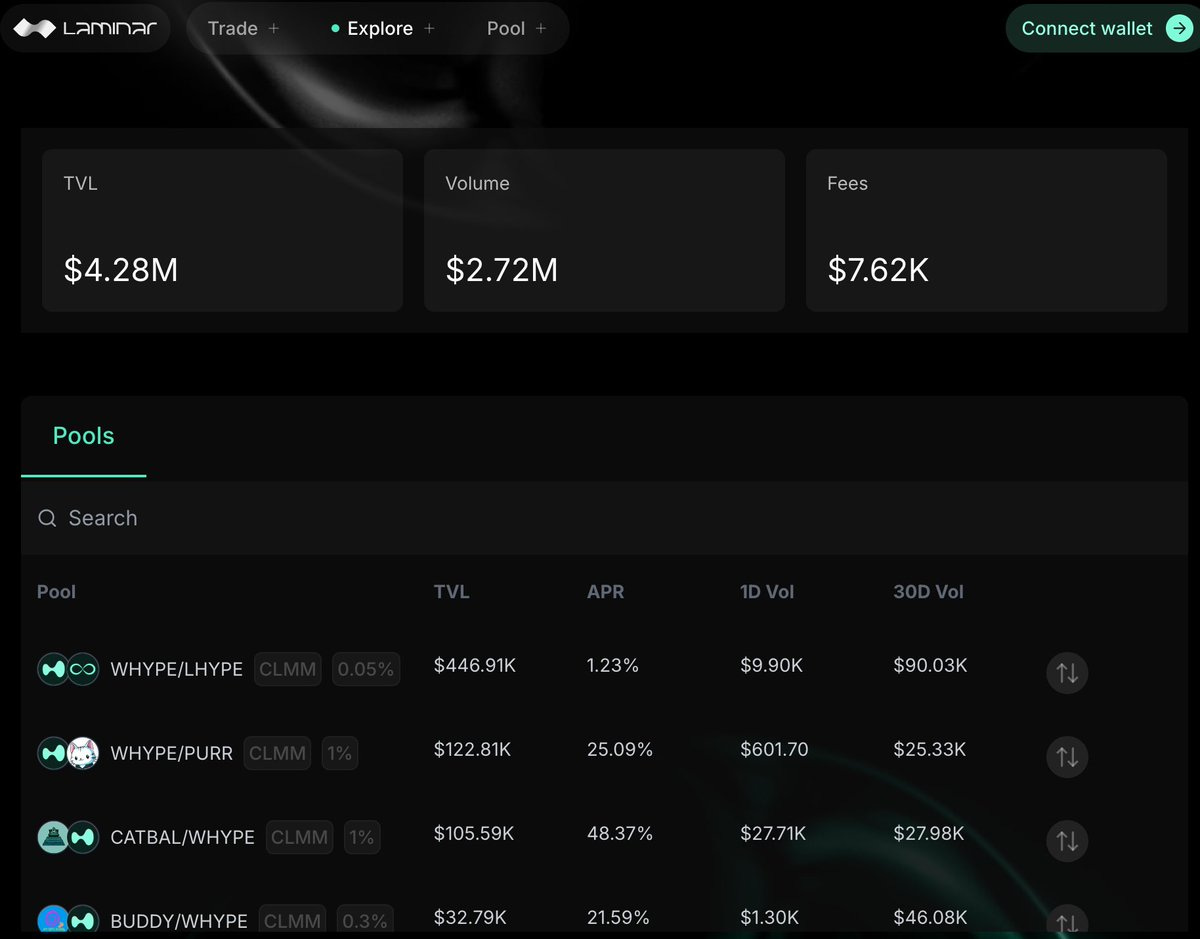

Laminar serves as a bridge and infrastructure provider for HyperEVM DEXs to access HyperCore. Its hybrid AMM/orderbook structure offers architectural differentiation. Though still early, the direction is promising.

Although the implementation details are not yet clear, the theoretical direction is well-defined, and it could emerge as a new variable in the competitive landscape of HyperEVM DEXs. As of March 27, it has recorded a TVL of $4.28 million and a trading volume of $2.72 million, and has already launched an alpha version based on Uniswap v3.

References

Disclaimer

This document is research material based on information about AMM DEX projects (HyperSwap, KittenSwap, Laminar) within the Hyperliquid and HyperEVM ecosystem. It is not intended as investment advice. All figures are based on public data and are subject to change. Readers are responsible for their own interpretation and decisions.